Challenges tend to create new markets, and the climate crisis is no different. With growing awareness of the need to reduce greenhouse gas (GHG) emissions, companies, governments and individuals are turning to carbon credits as a way to offset their carbon footprint.

And so that you can better understand what carbon credits are and how the market works, this article provides a comprehensive guide on the subject.

Here, we will explore the concepts, different types of credits, the markets where they are traded, and the controversies and challenges that accompany their implementation.

What is carbon credit?

Carbon credit is a concept created from the Kyoto Protocol in 1997 and is a certificate that represents one metric ton of carbon dioxide (CO2). That is, this credit can be generated through removal, reduction or capture.

These credits are therefore granted for projects that aim to remove greenhouse gases from the atmosphere and reduce or avoid greenhouse gas emissions. Examples include reforestation, the use of renewable energy, and the capture of methane in landfills, among others. Another example would be to protect an area of native vegetation that would likely be deforested in the absence of the project.

That way, companies, governments or other types of organizations can purchase these credits to offset their own carbon emissions while meeting regulations or sustainability targets.

Even if companies have ways to improve processes and reduce environmental impacts, any industrial action will generate an environmental impact in the form of GHG emissions. In other words, no matter how much effort organizations make and how much reduction strategies they apply, they still cannot achieve neutrality in emissions. And carbon credits are a way to offset these emissions.

Including, sectors such as petrochemicals, mining, energy and aviation, which are large emitters, still rely on a significant volume of carbon credits to offset part of their emissions. (Check the full listing)

These credits are traded in carbon markets, which can be regulated by government legislation or operate as voluntary markets, as will be explained below.

How does a carbon credit project work?

The process of generating carbon credits involves several steps that result in the reduction or removal of one ton of certified carbon equivalent. As previously stated, Carbon credits are developed through projects that reduce, prevent, capture or remove greenhouse gas emissions from the atmosphere.

Starting a carbon credit project – REDD (Reducing Emissions from Deforestation and Forest Degradation)

The first step is to assess the baseline scenarios and then understand whether the project is additional.

And this scenario, without the project, is called the baseline. In other words, the baseline refers to the estimated amount of greenhouse gas emissions that would occur in the absence of the emissions reduction project. It is a hypothetical scenario that serves as a reference point against which the project's actual emissions reductions are measured. The baseline scenario has a specific methodology that varies according to the type of project.

Indeed, the accurate definition of the baseline, together with additionality, is essential for the integrity and credibility of carbon credit projects and to ensure that these projects have a real impact on the global reduction of greenhouse gas emissions.

Validation of a carbon project – REDD

Validating a carbon project is a critical step that occurs before its effective implementation. It serves to ensure that the project is well planned, complies with the estimation methodologies, is technically feasible and is actually capable of reducing greenhouse gas emissions as proposed.

Validation is performed by an independent and accredited third party, known as a validating entity. In this case, the audit process involves the detailed analysis of the Project Design Document (PDD) and all the documentation attached to that project (e.g. baseline models, maps, documents, etc.), which details all aspects of the project and undergoes an on-site verification of the project.

The main aspects analyzed are:

Additionality Verification

Validation must confirm that the project delivers emissions reductions that are additional, i.e. that would not occur in the absence of the project.

Baseline Analysis

The validating entity analyzes the methodology used to calculate the emissions baseline and verifies whether it is adequate, transparent and in accordance with the established methodologies.

Environmental and Social Compliance

The project is assessed for its compliance with environmental and social legislation and standards.

Public Consultation

Many carbon credit standards require a public consultation phase, where interested parties can review and comment on the project. This promotes transparency and allows the local community to have a voice in the process.

Issuing the Validation Report

After the analysis is complete, the validating entity issues a validation report.

Registration

A validated project is then registered and can be part of a regulated or voluntary carbon market.

With all these steps, it is easy to understand that validation is essential to guarantee the integrity, transparency and effectiveness of carbon credit projects, helping to build trust in the carbon market and ensuring that projects genuinely contribute to the mitigation of climate change.

Implementation – REDD

After validation, the project is implemented. During this period, the project must monitor and record all relevant emission reductions.

Verification – REDD

Periodically, the project must be verified by another independent party. The verification process is carried out in a period that has already occurred in the project, in which case, what was validated is recalculated according to what actually occurred during that period.

At this stage, the project needs to produce a monitoring report, which includes evidence of activities carried out during this period. The verification process also involves an audit, in which it evaluates both the written document with the evidence and also performs the audit in the field.

Validation and verification audits can occur simultaneously, as long as the project has already been monitored for a period of time. Or they can occur in two distinct phases. After the audit, the auditor issues a report with some questions and the project proponent is responsible for answering them. This process can occur in up to three stages.

The auditor then generates a report for the certifying body. The certifying body has an evaluation period during which it can ask the auditor some questions, and this process can go through up to three rounds.

Certification and Issuance of Credits – REDD

If the project passes verification, then emissions reductions are certified, and carbon credits are formally issued.

Each carbon credit corresponds to the reduction of one metric ton of carbon dioxide or an equivalent of another greenhouse gas.

Registration and Trade – REDD

The credits are then recorded in an official registry to avoid double counting and can be sold on regulated or voluntary carbon markets.

How carbon credit trading works

The trading of carbon credits is a process that is part of the carbon market, a financial mechanism created to encourage the reduction of greenhouse gas emissions.

As seen above, after validation, the credits are registered in official systems or carbon registries, which function as a kind of “notary office” that confirms the ownership and validity of the credits.

Carbon credits can be sold in two types of markets:

Voluntary Carbon Credit Market

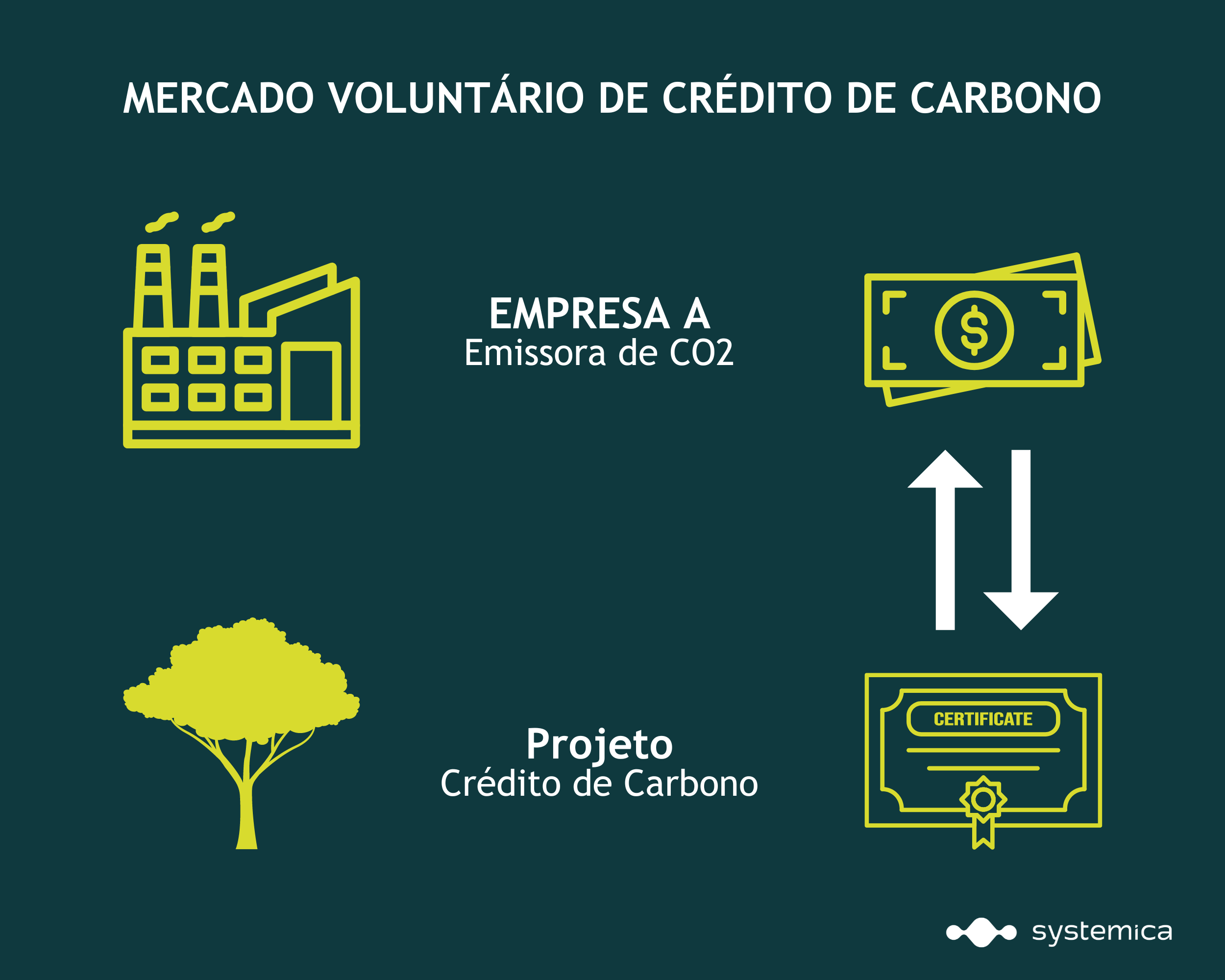

The voluntary carbon market (VCM) allows companies, governments and individuals to purchase carbon credits to offset their emissions voluntarily. In other words, the VCM is not regulated by legal obligations, but rather operates under voluntary and self-regulatory standards.

(Example of how the voluntary carbon market works)

This market is particularly attractive for companies that want to improve their corporate image, meet internal sustainability goals or prepare for future carbon regulations.

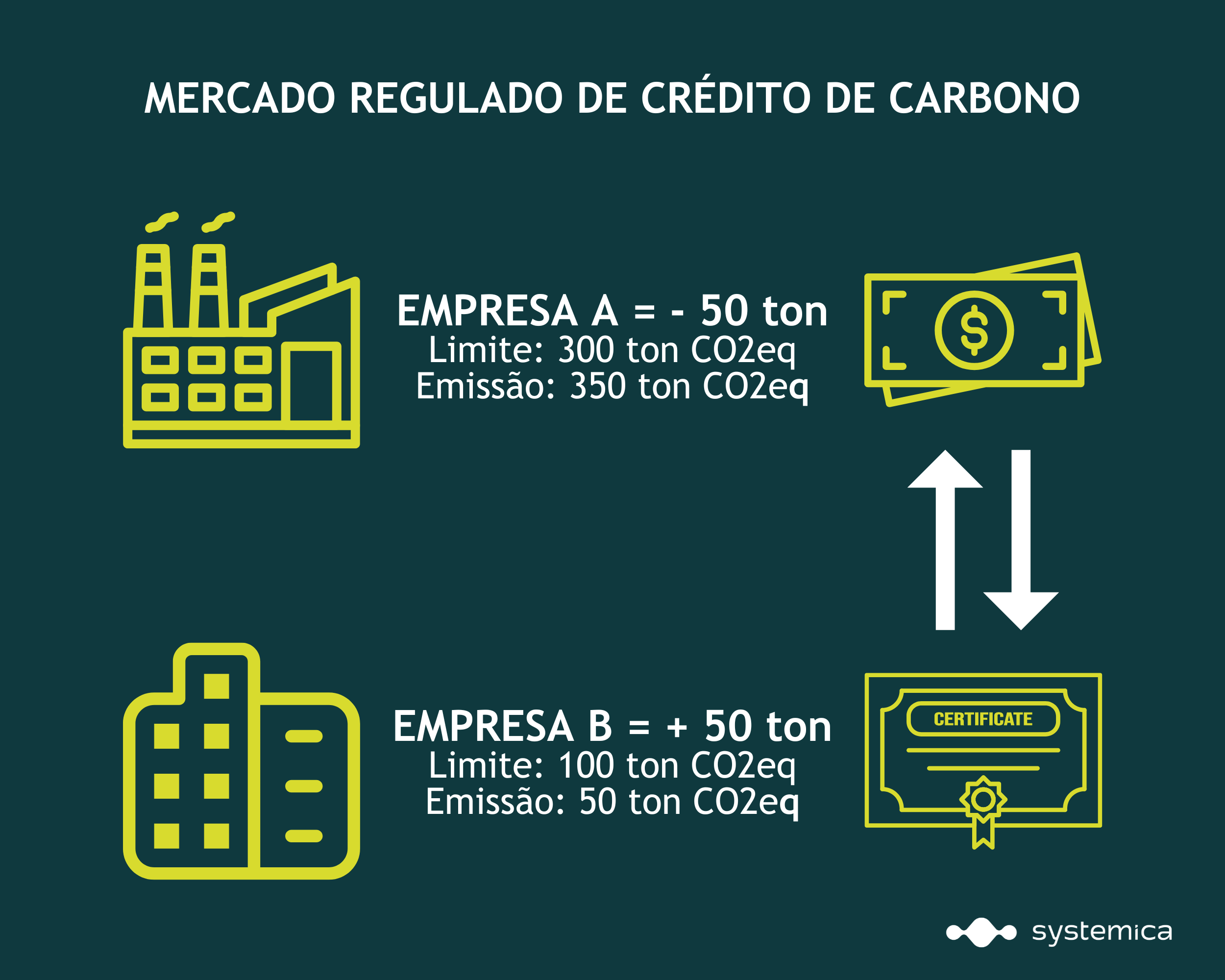

Regulated Carbon Credit Market

The regulated carbon market operates under government mandates and is designed to reduce greenhouse gas emissions on a large scale.

(Example of how the regulated carbon market works)

This market is a crucial component of many countries' climate policies and operates based on the following principles:

Legislation and Emission Targets

Governments set legal limits (caps) on the amount of greenhouse gas emissions that sectors or large industrial emitters can release. These limits are usually reduced gradually over time to meet emissions reduction targets.

Permission Allocation

Under these systems, companies receive or purchase emission permits. Each permit allows the holder to emit one tonne of carbon dioxide or its equivalent in other greenhouse gases. The initial allocation of permits can be done through free distribution or through auctions.

Permissions Trading

Companies that reduce their emissions below the permitted level can sell their excess allowances to others that are struggling to meet their emissions targets. This creates a market for emissions allowances and encourages companies to invest in cleaner technologies more cost-effectively.

Compliance and Penalties

Companies must report their emissions and demonstrate that they have sufficient allowances to cover their emissions. Failure to comply with limits can result in significant penalties, which may include fines or additional emission restrictions.

Flexibility Mechanisms

Some emissions trading systems allow the use of credits from emissions reduction projects outside the system to meet part of the obligations. These credits can come from projects in developing countries or from other reduction schemes.

These systems are considered an effective tool for reducing global emissions cost-effectively, promoting innovation and helping countries meet their international climate targets.

What to expect from the carbon credit market?

The carbon credit market is rapidly evolving and plays a critical role in the global strategy to mitigate climate change, offering a tangible path to carbon neutrality.

As markets grow and regulations increase, these mechanisms are expected to become even more crucial in global efforts to mitigate the effects of greenhouse gas emissions.

Systemica was created with the goal of transforming territories, positively impacting communities and biodiversity. And all of this is possible precisely because we generate and execute carbon credit projects.

If you want to understand more about the subject, visit the our website.